Currently, with the demand for products such as mobile phones and PCs in the global consumer market becoming increasingly sluggish, industry manufacturers are troubled by the large inventory of chips that are difficult to digest. However, the prosperity of automotive chips stands in stark contrast to the sharp decline in other tracks, and the automotive market, which is developing towards electrification and intelligence, is emerging with a huge demand for chips.

Looking at the top global semiconductor companies, their recent financial reports have been affected to some extent by the adverse environment, but the automotive business has become the main force to support the performance of the business. In Qualcomm's Q4 performance, the automotive business is the only one that has achieved growth and has the largest increase; Intel's automotive business revenue in the fourth quarter was $570 million, a year-on-year increase of 59%, leading the growth of all Intel's businesses; Marvell also recently stated that although the company's overall revenue is expected to shrink, the automotive-related revenue in this quarter should increase by more than 30%.

Advertisement

Looking at the large automotive chip manufacturers, TI said at the performance briefing that all terminal markets performed weakly in Q4 last year except for the automotive business; NXP's automotive chip sales increased by 25% last year, and Renesas' automotive business increased by nearly 40% last year, and both are expected to grow further in this quarter.

Infineon even stated directly that the production capacity of the automotive department has been fully sold out in the 2023 fiscal year. In the future, the development of automotive intelligence and electrification will continue to drive the continuous increase of automotive semiconductor content and the overall market size.

Under this situation, traditional automotive chip manufacturers such as Infineon, Texas Instruments, Renesas Electronics, NXP, STMicroelectronics, and ON Semiconductor have continuously expanded production.

Large automotive chip manufacturers are expanding production on a large scale.

Infineon: The largest single investment in history.On February 16th, Infineon announced an investment of 5 billion euros to build a 12-inch wafer fab in Dresden, Germany. This is the largest single investment in Infineon's history and will create approximately 1000 high-threshold job positions. It is reported that the new factory for analog/mixed-signal technology and power semiconductors is planned to start production in 2026, with its analog/mixed-signal components and power semiconductors mainly used in automotive and industrial applications, such as automotive motor control units, energy-saving charging systems, etc.

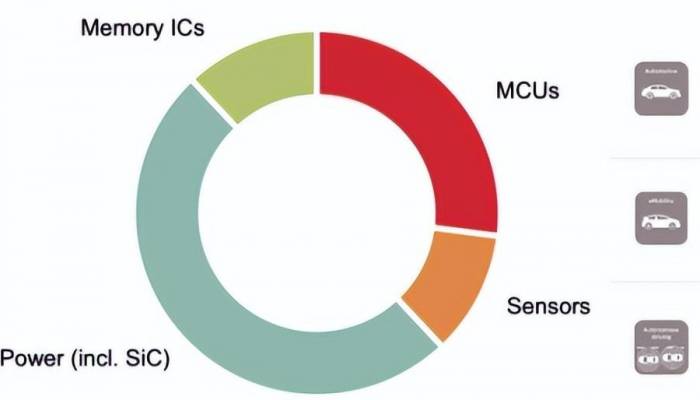

In 2023, Infineon will focus on the development of the SiC, BMS, and MCU markets. SiC power devices are centered around the 800V system in the automotive industry and are also being widely used in chargers and power supplies. Among them, the BMS BOM cost for each electric vehicle is about 100 US dollars, with a broad market space.

In the MCU market, with the upgrade of the automotive E/E architecture, Infineon expects a significant increase in its MCU revenue. Infineon's MCUs are mainly focused on safety and are mainly used in the fields of safety, ADAS, chassis, and powertrain, including gateways, airbags, EPS, EPB, ESP, active suspension, millimeter wave radar, etc., with the TC3X/TC4X series as the main force.

In addition, in 2023, Infineon's MEMS mirror AR HUD is also a main push, as well as MEMS microphones, LED headlight driving ICs, and various high-power motor driving ICs.

Texas Instruments: Vigorously expanding the 12-inch wafer fab

Texas Instruments' automotive business revenue reached 5 billion US dollars in 2022, with an absolute overwhelming advantage in the power management IC field, with a market share estimated to exceed 60%. The strong demand for power management ICs in electric vehicles has driven the rapid growth of Texas Instruments' automotive business. At the same time, capacity constraints have also accelerated Texas Instruments' expansion pace.

Almost simultaneously with Infineon's expansion news, Texas Instruments announced on February 16th that it will invest 11 billion US dollars to build a second 300mm wafer manufacturing plant in Lehi, Utah, USA, mainly producing analog and embedded processing chips. It is expected to start construction in the second half of 2023 and will be put into production as early as 2026. It is reported that the factory is adjacent to Texas Instruments' existing 12-inch wafer manufacturing plant LFAB in the area, and after completion, these two factories will be merged into one wafer manufacturing plant for operation.

In December 2022, Texas Instruments' LFAB factory had already started producing analog and embedded products. The Lehi wafer factory originated from Texas Instruments' acquisition of Micron's 12-inch wafer factory for 900 million US dollars in July 2021. The wafer factory has more than about 25,548 square meters of clean room space, and highly advanced facilities include an automated overhead conveyor system of about 11,265 meters, which can quickly transport wafers throughout the entire wafer factory. The total investment in the Lehi wafer factory will reach about 3 to 4 billion US dollars. LFAB has the capability to support 65-nanometer and 45-nanometer technologies.In fact, as early as May 2022, Texas Instruments' new 12-inch semiconductor wafer manufacturing base in Sherman, Texas, has officially broken ground. The total investment of the Sherman wafer manufacturing base is 30 billion US dollars, and the first factory is expected to start production in 2025.

In September 2022, Texas Instruments' latest 12-inch wafer factory in Richardson, Texas, USA, began preliminary production, expanding its scale for several months to meet the semiconductor demand for the future growth of electronic products. RFAB2 is connected to RFAB1 and is one of the six new 12-inch wafer manufacturing factories added by Texas Instruments. RFAB1 started production in 2009 and was the world's first 12-inch analog wafer factory at that time.

Overall, Texas Instruments has begun to strengthen its own production scale, in sharp contrast to many other IDM companies that are increasingly dependent on outsourcing.

Renesas Electronics: Restarting 12-inch Wafer Factory

Renesas Electronics is also considering expanding production.

Not long ago, in an interview, Renesas Electronics CEO Hidetoshi Shibata said that building and operating a new factory in Japan faces challenges, such as high costs of water and electricity, frequent earthquakes, and limited talent, but Renesas will still expand production. Renesas will consider expanding chip production capacity in areas outside of Japan to reduce the risk of supply chain disruptions to car manufacturers and other important customers in the future.

According to the 2022 financial report, thanks to the good performance of the automotive and industrial markets, Renesas Electronics achieved a total sales amount of 1.5 trillion yen in 2022, a year-on-year increase of 51%, and once again exceeded the important threshold of 1 trillion yen after many years; the net profit was 256.8 billion yen, a year-on-year increase of 114.5%, achieving double growth for three consecutive years.

It is understood that Renesas Electronics currently has six wafer factories and seven packaging and testing factories, of which two packaging and testing factories are in Beijing and Suzhou. At present, Renesas' wafer factories are basically in Japan, and most of the traditional Renesas products are produced by their own factories. However, 40nm and below advanced process products will choose to outsource to TSMC and UMC for production.

Among them, Renesas Electronics' automotive MCU products rank first in the world, actively expanding production to meet the strong demand downstream.

In recent years, driven by the strong demand for new energy vehicles, various automotive products are in short supply, and MCUs are one of the main products in short supply. At an early business briefing, Renesas Electronics clearly stated its plan to increase production capacity, planning to increase the production capacity of automotive MCUs by 50% starting from 2021. If calculated by 8-inch wafers, the high-end MCU production capacity will be expanded by 1.5 times to about 40,000 pieces per month, and this part of the production capacity mainly relies on the production line of wafer foundries; as for the low-end MCU, the plan is to increase it to 30,000 pieces per month, a 70% increase from the current level, and this part of the production capacity will mainly be met by increasing its own factory production capacity.In the field of power semiconductors, Renesas Electronics possesses the technology and production capabilities for both MOSFETs and IGBTs.

In May 2022, Renesas Electronics announced an investment of 90 billion yen in the Kofu factory, which was closed in October 2014, with the aim of reviving its 300mm power semiconductor production line by 2024 to meet the growing market demand for power semiconductor products such as MOSFETs and IGBTs. It was revealed that after the Kofu factory resumes full-scale mass production, the production capacity of Renesas Electronics' power semiconductors will double.

In August 2022, Renesas Electronics announced that the AE5 generation IGBT products, targeting next-generation electric vehicle inverter applications, will begin mass production in the first half of 2023 on the 200mm and 300mm wafer lines at Renesas' Nikko factory in Japan. In addition, Renesas will increase production at its new 300mm wafer factory for power semiconductor devices in Kofu, Japan, from the first half of 2024 to meet the growing market demand for power semiconductor products.

At the performance briefing, Renesas Electronics stated that the growth of the company's automotive business is mainly due to the increase in the amount of semiconductors equipped per vehicle and the improvement of the product mix. With new devices and products about to enter mass production, Renesas will create ideal functions and cost-effectiveness for the MCU and EV inverter markets, which are expected to grow rapidly in the future.

Looking ahead, Renesas Electronics pointed out that by 2025, the company's revenue will increase from the current over 10 billion US dollars to more than 20 billion US dollars, and it will continue to focus on the company's two core businesses through organic growth and external mergers and acquisitions to ensure the realization of this goal.

STMicroelectronics: Continued optimism about the automotive market

Benefiting from the strong demand in the automotive market, the financial report of the global power chip giant STMicroelectronics (ST) also appears optimistic.

According to the financial report, STMicroelectronics achieved revenue of 16.3 billion US dollars in 2022, a year-on-year increase of 26.4%, with a gross margin of 47.3%. The growth momentum in the annual performance mainly came from the automotive and industrial sectors. Among them, the revenue of the ADG business unit, where the automotive industry is located, accounted for 37% of ST's total revenue, and the automotive business alone accounted for 23% of ST's revenue.ST is the world's largest SiC manufacturer and an exclusive supplier to Tesla. In 2022, ST's SiC business revenue was approximately $700 million, with an expected increase to $1 billion in 2023, of which 75% comes from the automotive sector and 25% from the industrial sector.

As a leading company in the automotive chip industry, ST has been actively expanding its production capacity in recent years. It is reported that in 2023, ST plans to invest about $4 billion in capital expenditures, mainly for the expansion of 12-inch wafer fabs and silicon carbide manufacturing capabilities.

The expansion of SiC production capacity is primarily in Catania, Italy, and Singapore, with the 8-inch wafer fab expected to be operational in 2023. The wafer fab in Italy will become the first factory in Europe to mass-produce 8-inch SiC epitaxial substrates. The Italian government will invest €730 million in the factory over five years under the framework of the National Recovery and Resilience Plan.

On August 4, 2022, ST also announced a collaboration with GlobalFoundries to establish a new jointly operated 12-inch semiconductor manufacturing factory near ST's existing 12-inch fab in Crolles, France. The new factory will mainly produce products using FD-SOI or fully depleted insulator-on-silicon semiconductor manufacturing technologies, with production expected to start by the end of 2023.

Looking ahead to 2023, ST anticipates a revenue growth of over 10% in the automotive business.

ON Semiconductor: Betting on SiC Production Capacity

On February 11, ON Semiconductor officially took over a 12-inch fab from GlobalFoundries in New York and pledged to invest $1.3 billion in it. ON Semiconductor stated that the fab will produce chips supporting electric vehicles, electric vehicle charging, and energy infrastructure, which will enable the company to accelerate growth in the major trends of automotive electrification, ADAS, energy infrastructure, and factory automation.

In the SiC field, ON Semiconductor CEO Hassane El-Khoury pointed out that over the next three years, ON Semiconductor will commit to $4 billion in revenue for SiC, with about $1 billion in 2023, and a potential growth of about 30% in 2024 and 2025, reaching $1.7 billion.

To achieve this goal, ON Semiconductor has doubled the production capacity of SiC wafer fabs and plans to double it again in 2023, followed by another doubling in 2024.

NXP: Automotive Revenue Accounts for More Than Half

(Note: The original text ends abruptly, and the information for NXP is incomplete. Please provide more details for a complete translation.)Benefiting from the sustained strong demand in the automotive sector, NXP's automotive business revenue in Q4 last year increased by 17% year-on-year, accounting for as much as 55% of total revenue, with its total revenue also achieving a 9% year-on-year growth. It is expected to grow by about 15% in the first quarter of this year.

According to the introduction, the main drivers of NXP's revenue in the automotive field come from 77GHz millimeter wave radar, power management solutions, inverters, and other electric vehicle controllers.

Regarding the future expectations of the automotive market, NXP stated that most of the demand in the chip industry is plummeting like a falling stone, with an overstock problem. However, the demand for automotive and industrial chips still has "resilience." At present, NXP is also considering expansion in Texas.

With the digital revolution in the automotive industry, cars are increasingly becoming technological products that consume more semiconductors. NXP's management team estimates that by 2024, the revenue line will grow by 20%-25%.

Other manufacturers are also actively deploying.

In addition to the major automotive chip manufacturers mentioned above, there are other automotive chip manufacturers actively planning.

Rapidus, a chip manufacturer funded by the Japanese government, said on February 16 that it is considering setting up a factory in Hokkaido, Japan. It is reported that this factory is likely to be used for the expansion of automotive chip production.

On February 17, Microchip also announced plans to invest $880 million to expand its silicon carbide and silicon production capacity at its production base in Colorado Springs, Colorado, over the next few years. It is reported that the production capacity of this factory is mainly used in fields such as automotive, power grid infrastructure, green energy, and aerospace. Microchip Technology will also add an 8-inch wafer production line in the future.

Wolfspeed previously announced plans to build an 8-inch SiC wafer factory and R&D center in Saarland, Germany, with German automotive supplier ZF. In addition, after the Tier1 giant Bosch's 12-inch wafer factory started production in 2021, it announced additional investment to expand production.

From the above information, it can be seen that the expansion plans of the world's major analog/automotive chip manufacturers are relatively dense. In China, there are also manufacturers such as Silan Microelectronics, Wenyuan Technology, and Weier Semiconductor that have started to build 12-inch lines. If the construction goes smoothly, they will probably start production in two or three years.Car Chip Giants Expand Production, Showing What Trends?

From the expansion dynamics of the above car chip giants, the trend towards 12-inch wafers and the layout of SiC capacity is the direction that industry leaders are focusing on.

Intensified Competition in 12-inch Wafers

This is not hard to understand. Behind the 12-inch wafer's victory in area, there is a dual advantage of cost reduction and performance improvement. Although the production cost of 12-inch wafers is about 50% higher than that of 8-inch wafers, the chip output is close to three times that of 8-inch, and the cost per chip is reduced by about 30%.

In the future, as the process technology matures and the yield increases, the cost of 12-inch wafers is expected to be further reduced. Therefore, international IDMs are taking the lead in migrating high-profit automotive MOSFETs and IGBTs and other power devices from 8-inch to 12-inch to enhance their competitiveness in this field.

Faced with the reality of more new capacity being opened in the future, the competition for 12-inch wafers will be unprecedentedly fierce, especially in mature processes.

SiC Becomes the Next Betting Trend

The focus of the above-mentioned large factory expansion, with the most vigorous growth momentum in SiC.

Due to the advantages of SiC devices, such as high-temperature resistance, low loss, good thermal conductivity, corrosion resistance, high strength, and high purity, and far superior to traditional silicon-based semiconductors in parameters such as bandgap, insulation breakdown field strength, thermal conductivity, and power density, its application in electric vehicles, fast charging piles, power management, and other fields is gradually expanding.

According to market analysis agency Yole, in the next five years, SiC power devices will quickly occupy 30% of the entire power device market, and it is expected that by 2027, the output value of the SiC industry is expected to exceed 6 billion US dollars.This can also explain why major original equipment manufacturers (OEMs) have invested heavily in the research and development and construction of SiC semiconductors in the past two years.

Not only are international giants rapidly deploying, but the domestic SiC industry is also exceptionally hot. According to incomplete statistics, in 2022 alone, there were 31 financing cases of silicon carbide companies in China, totaling more than 3.3 billion yuan. Throughout 2022, the expansion and mergers and acquisitions in the SiC field have become a global phenomenon.

On the other hand, in-depth cooperation between car companies and SiC semiconductor manufacturers is also in full swing, and it is expected that more and more car companies will launch models based on SiC devices in 2023.

From the enthusiastic investment and expansion of major manufacturers, 2023 will be a year when the SiC industry will see explosive growth, or it may be the year when SiC takes off.

In conclusion, Morgan Stanley pointed out that the global automotive electronics market was about 150 billion US dollars in 2018, and it is expected to grow explosively to 287 billion US dollars by 2025. The main reason is the continuous improvement of the penetration rate of electric vehicles, coupled with the increased use of ADAS. It is expected that by 2025, 35%-45% of the material cost of electric vehicles will be automotive electronic components, which is 2.5 times that of traditional cars, and the overall demand for automotive chips is expected to grow.

At present, more than 80% of the global automotive chip supply is in the hands of international IDMs such as Infineon, NXP, Renesas Electronics, Texas Instruments, STMicroelectronics, and ON Semiconductor. As IDM manufacturers expand their own production capacity, their own automotive chip supply will be smoother, and car manufacturers can get rid of the haze of chip shortages. However, this will also put pressure on the foundries that have recently increased the capacity of automotive-grade chips.

In the face of the huge market size, in addition to traditional manufacturers looking for business strategy points, there are also a large number of newcomers flocking. At the same time, in order to shorten the delivery period, car manufacturers such as Tesla, BYD, and Great Wall Motors have also started joint research and development, and even self-research and development of automotive chips to improve the rate of autonomy.

With the entry of new players and the emergence of new business models, the competition in the automotive chip industry has intensified, with both challenges and opportunities coexisting. As a lifeline for semiconductor companies, industry manufacturers are striving to take over the growth baton of the automotive market.

Post Comment