It is believed that Samsung Semiconductor has set a goal for many years, that is, to develop the wafer foundry business and its own LSI business.

As a storage giant, Samsung has seen the "cyclical" fierceness of standard products such as DRAM and NAND Flash over the past many years. At the same time, TSMC's "lonely pursuit of defeat" in wafer foundry and Apple's "all-round killing" in self-developed chips also made them "envy".

In fact, Samsung announced an investment plan and target for the future in 2019, planning to invest about 120 billion US dollars in the next 12 years (1999-2030) to strengthen the competitiveness of system LSI and wafer foundry business. Overall, Samsung hopes to maintain the world's first position in storage chips, surpass TSMC in the wafer foundry field, defeat Sony in the CMOS image sensor field, lead Intel in revenue, and firmly hold the position of the world's largest semiconductor manufacturer.

Advertisement

However, according to a report by the South Korean media "Jongang Ilbo", Samsung's chip division may incur nearly 1 billion US dollars in operating losses in the first half of this year, so the gap between Samsung and TSMC is widening. But Samsung does not admit defeat and continues to fight to the death.

Advanced packaging, attracting talents

One of the criticisms of Samsung's wafer foundry business is the company's lack of advanced packaging business. Because according to relevant reports, as the manufacturing process reaches the limit, manufacturers can no longer rely solely on violent reduction of crystals to achieve a dramatic increase in chip performance, so advanced packaging has become the new support of major manufacturers. Samsung's strongest competitor, TSMC, has successfully won new orders from multiple customers through this business layout.

However, Samsung's performance in this area is also not satisfactory, and there are few reports about them. But last year, the South Korean media BusinessKorea reported that Samsung's wafer foundry business established a semiconductor packaging working group in mid-June of that year. The working group was composed of Samsung's wafer foundry department's test and system packaging (TSP) engineers, semiconductor R&D center researchers, and memory and foundry departments, and is expected to propose advanced packaging solutions and strengthen cooperation with customers.

Samsung's Chinese blog also wrote in an article published at the beginning of this month that Moonsoo Kang, the head of Samsung Foundry's business development, pointed out at the 2022 Samsung Wafer Foundry Forum (SFF) that Samsung Foundry's team has been trying to open up an advanced packaging development path "beyond Moore's Law" (Beyond Moore), pursuing the strong combination of "continuing Moore's Law" (More Moore) and "extending Moore's Law" (More Than Moore), and advanced heterogeneous integration is the key to achieving this goal.

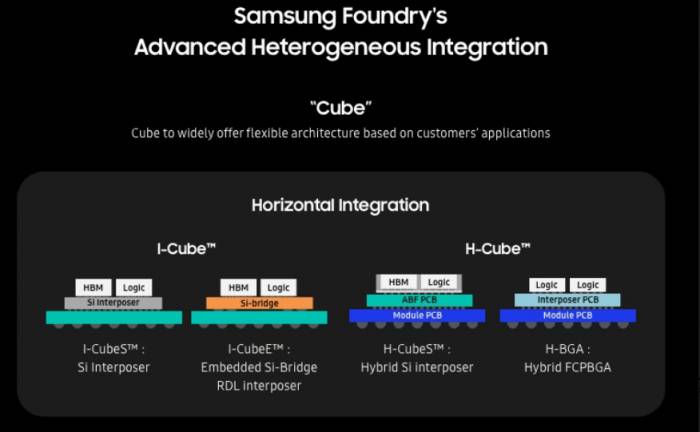

Based on such understanding, Samsung has developed three major advanced packaging technologies in the wafer foundry R&D department along the horizontal integration and vertical integration directions: I-Cube, H-Cube, and X-Cube.According to Samsung, I-Cube is a 2.5D packaging solution where chips are placed side by side on an interposer. To enhance computing performance, I-Cube customers often request an increase in the interposer area. In response, Samsung has introduced two I-Cube solutions: I-CubeS and I-CubeE.

The full name of H-Cube is "Hybrid Cube," which is another 2.5D packaging solution launched by Samsung. This solution aims to address the current severe shortage of unit printed circuit boards (PCBs) in the semiconductor industry.

X-Cube is a full 3D packaging solution that uses vertical chip stacking technology. "X-Cube connects two vertically stacked dies through micro-bumps or more advanced copper bonding technology. We plan to start mass production of micro-bump type X-Cube products in 2024 and copper bonding type X-Cube products in 2026," said Kang.

To better develop the company's packaging business, it is rumored that Samsung has also recruited packaging expert Lin Juncheng, who worked at TSMC for 19 years.

According to foreign media reports, Lin Juncheng is a senior expert in the field of semiconductor packaging. He worked at TSMC from 1999 to 2017, coordinating the registration of more than 450 core patents in the United States for TSMC, laying the foundation for TSMC's current pride in 3D advanced packaging technology. It is reported that it was Lin Juncheng who led the team to establish TSMC's proud advanced packaging technology product line CoWoS/InFO-PoP and successfully introduced mass production, winning large orders from Nvidia and Apple. Later, he joined Micron and also led the R&D team of Micron to establish a 3DIC advanced packaging development product line and develop high bandwidth memory (HBM) stacking technology.

It is worth mentioning that before recruiting Lin Juncheng, Samsung also poached semiconductor expert Jin Yuping from Apple and appointed him as the head of the U.S. packaging solutions center.

Of course, Samsung's recruitment of talents does not mean that the company will definitely succeed in this field, but at least they have taken an important step.

High-performance chips, starting anew

For Samsung, in order to achieve its long-term goals, it is also very important to rebuild its self-developed mobile chips. This is not only related to the future development of its mobile business but also greatly benefits the company's future expansion into PC, automotive chips, and more high-performance chip businesses.

Looking at the layout of this South Korean chip giant in recent years, they have also taken every step to "win" in this field.As early as 2019, there were reports that Samsung would stop developing its own CPU cores. The company's Austin Semiconductor Factory, which was responsible for the research and development of related businesses, planned to close on December 31 and lay off 290 employees from that department. The other nearly 3,000 employees were unaffected. Michele Glaze, a spokesperson for Samsung at the time, confirmed the news and said that this move was a difficult choice made after looking forward and evaluating future business.

In May 2022, there were reports that Samsung was establishing a special task force within the company called "Dream Platform One Team." The true purpose of this so-called "Dream Team" is to design a customized Samsung mobile processor that can compete with Apple Silicon developed based on the M1 mobile processor.

At the beginning of this month, reports cited sources as saying that a Samsung team led by a former senior engineer from AMD will accelerate the development of the next generation of "Galaxy Chip(s)." The medium-term goal is to transfer its laptops and smartphones from Arm to internal CPU cores by 2027.

The report said that Samsung's goal is to use its own CPU cores for smartphones and laptops. The first processors based on this new research and development work are expected to be released in 2025. They will abandon the Exynos brand and be called "Galaxy Chip(s)." From the report, it can be seen that the first Galaxy Chip products may still use CPU cores based on the Arm architecture. However, the source indicated that if everything goes as planned, Samsung will be ready to launch its own architecture CPU cores before 2027. However, Samsung later denied the claim of self-developed cores.

As another important part of self-developed chips, Samsung's investment in GPUs is also keeping pace with the times, and in this area, they have chosen to cooperate with AMD.

In January 2022, Samsung announced the launch of a new high-end mobile processor, the Exynos 2200. One of the biggest features of this new mobile processor is the powerful Samsung Xclipse graphics processing unit (GPU) based on the AMD RDNA 2 architecture. Samsung said that this Xclipse GPU, which is between the console and mobile graphics processor, is a very special hybrid graphics processor. Based on the high-performance AMD RDNA 2 architecture, Xclipse inherits advanced graphics features such as hardware-accelerated ray tracing (RT) and variable rate shading (VRS) that were previously only available on PCs, laptops, and game consoles.

From the market response, it seems that Samsung's chip (including the GPU) did not meet the expectations of consumers and Samsung. However, Samsung reiterated that the company will continue to cooperate with AMD and adhere to the use of RDNA architecture for mobile GPUs. Sungboem Park, the vice president of Samsung responsible for mobile GPU development, said that Samsung has officially confirmed that its future Exynos series mobile processors will continue to use GPUs based on the AMD RDNA architecture. In addition, Samsung also plans to continue to adopt the RDNA series to achieve other functions through close cooperation with AMD.

In addition to mobile chips, Samsung is also making efforts in automotive chips.

In February of this year, according to Businesskorea, Samsung Electronics hired Benny Katibian, who once served as the vice president of Qualcomm's engineering department, as the senior vice president of its U.S. company and the head of Samsung Electronics' core R&D center in the United States - Samsung Austin Research Center (SARC) and Advanced Computing Lab (ACL).

The report pointed out that this recruitment is part of Samsung Electronics' efforts to expand its automotive system chip (SoC) business, which has huge growth potential. Samsung Electronics' system LSI department has already launched the Exynos Auto, which is an AI-based automotive processor. Samsung's current top priority is to upgrade the Exynos Auto to strengthen its market leadership.From the latest reports from foreign media, it can still be seen that the cooperation between Samsung and Hyundai Motor in the field of automotive chips is underway. Samsung Electronics will design and manufacture logic chips for Hyundai Motor, which are planned to be used for advanced driver assistance systems and infotainment systems in future models.

In conclusion,

To achieve the company's semiconductor ambitions, Samsung recently announced plans to invest about 300 trillion won ($229 billion) over the next 20 years to build a new chip cluster in the suburbs of Seoul, aiming to realize South Korea's ambition to lead the global chip manufacturing industry. According to the report, Samsung's investment will be the core part of the plan, with the goal of building five memory and foundry wafer factories in a new chip cluster in Yongin City before 2042, to attract more than 150 local and foreign chip companies.

In addition to these businesses, Samsung will continue to invest in CIS to achieve the goal of overtaking Sony. In terms of substrates, which are very important for high-performance chips, Samsung announced in July last year that the company began mass production of FC-BGA (flip-chip ball grid array packaging) for server use in South Korea for the first time, and stated its ambition to become the world's third-largest IC packaging substrate factory. By the time of the news release last year, Samsung Electronics had invested $227 million in domestic production lines to produce next-generation substrates. Over the past two years, the company has invested 2 trillion won to expand FC-BGA production facilities.

In addition, Samsung has also followed TSMC's footsteps in developing its own EUV photomask pellicle, and the company has many other layouts in self-research and investment. Coupled with the company's continuous consolidation in the storage business, Samsung has added an important support on the road to semiconductor dominance.

Although there are many challenges, the difficulty is huge and even failure. But Samsung has always been on the road forward. This kind of perseverance is also worth learning from the vast number of semiconductor practitioners in the country.

Post Comment